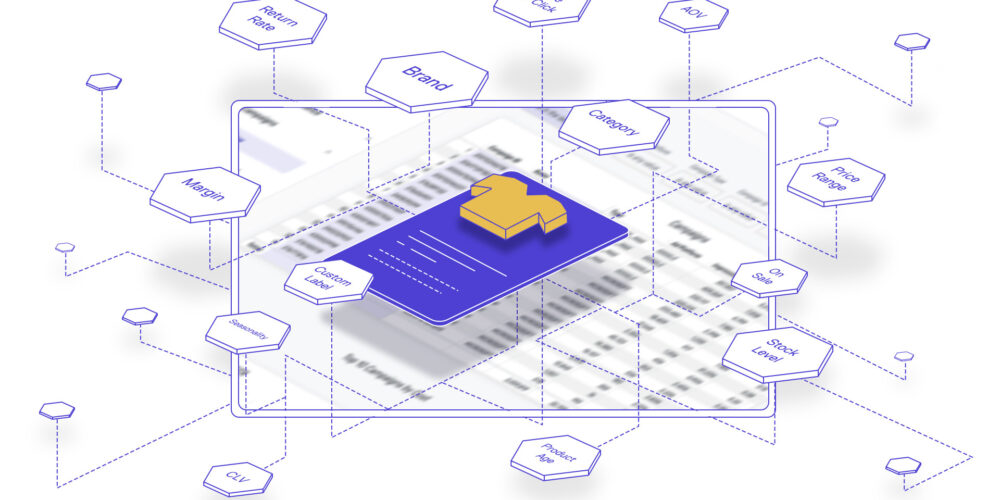

The tides in digital advertising are shifting. Highly automated, all-encompassing digital campaign types, like Google and Microsoft’s Performance Max (PMax), ring in a new era of streamlined marketing at the expense of granular user control. A key challenge with PMax is its broad-brush approach to product catalogs. In its quest…

Product scoring in PMax & more digital ads trends in 2024

If you thought 2023 was a roller coaster ride for online retail, you ain't seen nothing yet. 2024 brings a new set of challenges, but also…

Hot PMax questions: best campaign setup, reporting, incrementality & more

There’s an interesting contradiction at the heart of Performance Max campaigns. On the one hand, this is Google’s latest technology, featuring unprecedented levels of automation…

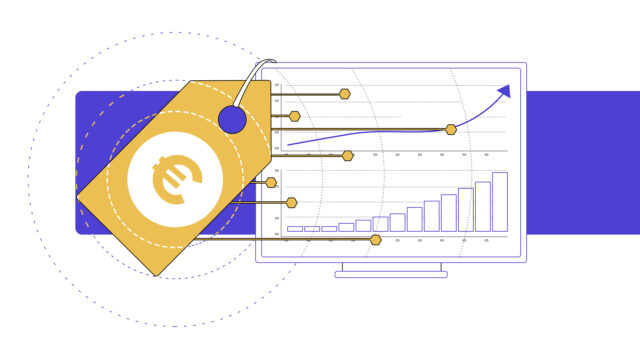

How pricing influences conversion rates: A case study

In 2024, the global economy will face unprecedented challenges and transformations. Inflationary pressures and fluctuating market conditions shape consumer spending habits worldwide. Price sensitivity has…

From Data to Triumph: Decoding Target ROAS (tROAS) in 3,000 PMax retail campaigns

In the world of ecommerce advertising, leveraging the right bidding strategy can make all the difference in campaign success. Performance Max (PMax) campaigns have become…

Ecommerce strategy for Black Friday & holiday season 2022

In this year's holiday season, online retailers are in for a ride, as the ecommerce sector is shaken by severe economic disruptions: war in Europe,…

Performance Max for retail: Your questions answered by an expert

For online retailers using Google Ads, Performance Max is a real black box that represents a new obstacle in the digital advertising world. And, even…

Performance Max campaigns: Successful strategies for online retail

Performance Max (PMax) campaigns are the latest and most extensive example yet of automation in Google’s advertising platform. Hence, many online retailers are now looking…

We grow ecommerce together.

In the aftermath of a tremendous, pandemic-induced ecommerce boom we discovered that the retail industry is changing. If retailers need to stay up to speed…

NRF 2022: Retail’s Big Show

January is an exciting month for retail: Consumers and employees alike are returning after a well-deserved break, the final numbers of the previous seasons holiday…

Is Google Analytics illegal? Here’s our take

The new year started with a big bang in the digital world: The Austrian Data Protection Authority (Datenschutzbehörde) has ruled that the use of Google…

Performance Max vs Smart Shopping: What to know

On November 2, 2021, Google announced the rollout of Performance Max Campaigns (PMax Campaigns) to all advertisers. Performance Max Campaigns is Google's latest Smart Campaign…